September 2021

£7,140,000

£8,500,000

We provided a company in the professional services sector with an upper valuation for their business of £7.14million. The company had established relationships with top-tier contractors and consultants and acquired an enviable reputation for achieving success. In deciding to proceed with a sale, the company teamed up with our M&A partner who focused upon finding a buyer that could enable the business to continue delivering on its growth plan.

The benefit of this tailored, unique approach was that dozens of interested parties were identified and, after a competitive bidding process, the final offer accepted was for £8.5million – almost 20% above the original upper valuation.

I am incredibly optimistic about what this acquisition will mean for our team.

We can accelerate the growth of the business, explore new markets and target longer contracts.

We would never have got over the line without you. A real pleasure.

It is only natural for a business owner to be curious about what their company is worth. Perhaps you are considering a change of lifestyle or have plans for a new venture, either of which could require capital generated by an exit from your business. Ultimately, however, the value of your company is only what someone is willing to pay for it. In this report, we have provided you with a valuation based on the current industry trends and our history of working with Uk businesses. Whilst financial factors specific to your business form an important part of this report, this report will highlight the other drivers that also influence the final valuation. Should you decide an exit from your company is the right move for you, our partner company, with a quarter of a century’s M&A experience behind them, can advise and support you with a unique, tailored approach to the sale of your business. We hope you will find the report useful in deciding your next step, and we would be delighted to work with you should you wish to realise your value.

As you will see from the graphic above, rather than specifying a definitive single figure for your valuation we have provided a range in which we expect it to sit. This is because there are more factors to consider than purely the financial elements of your business. For instance, the strength of your brand within the market can influence its value, likewise the depth and loyalty of your customer base. Skilled, experienced management adds value, as does a high-quality, competitively-priced supply chain and the potential for synergies with a buyer’s existing operations. And, of course, there needs to be contingency for how much a buyer is willing to pay.

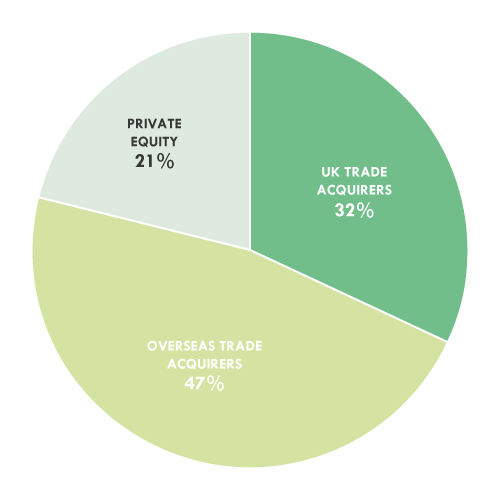

The graphic opposite illustrates that a wide range of buyer types have been acquiring within the UK during the past five years, highlighting UK trade, overseas trade, and investor activity.

As the M&A market in the UK remains robust, both domestic and overseas trade buyers across most major sectors are consolidating at a high rate to drive growth and expansion. This often means they are paying high multiples, with the transaction values of our M&A partner’s deals having risen by an average of 36% in just a single year. Meanwhile, publicly listed companies benefit from cash reserves of over £1.3 trillion, with acquisitions of UK businesses by listed buyers increasing by more than a third over the past two years.

Furthermore, investors are poised to invest record levels of cash reserves, which have risen to almost $2 trillion. Our M&A partner has reported that a significant volume of their deals in the sector now involve an investment acquirer, while the wider M&A market observed over 8,000 private equity deals involving UK targets during the past five years, which are collectively worth circa £350 billion.

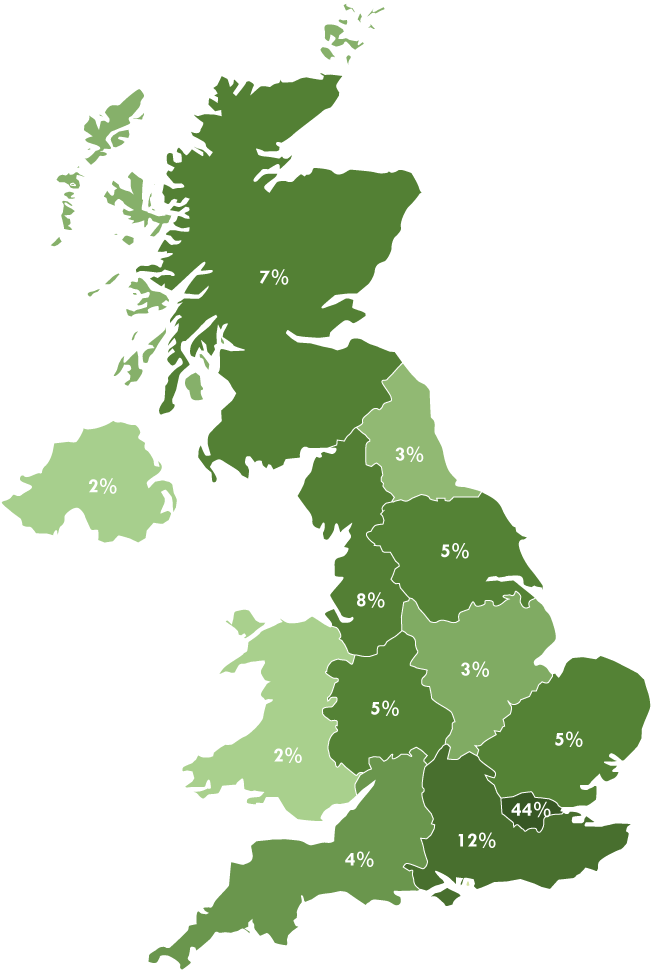

Over the past five years, we have seen transactions taking place across the entirety of the UK, as the map opposite demonstrates.

Across many sectors, it is natural to see higher levels of activity within the south east due to the increased concentration of companies registered within this part of the country. However, overall there is a strong spread of company sales transacting across every region of the UK.

This graph illustrates the area, shaded in blue, within the valuation range where the highest proliferation of business sales is completed within the UK. The curve indicates there is the potential for valuations at the upper end of the scale to be realised, dependent upon your business possessing the additional value drivers as described above. Features that make companies attractive to a range of buyer types can sell for well above the industry average price and potentially achieve a figure within the upper quartile value.

Realising a final transaction value at the upper end of the range is much more likely achievable with the support of an experienced M&A advisor. Their expertise within the industry will ensure a range of buyer types, who would benefit from the attributes offered by your company, can be identified – with the aim of generating a sizeable amount of interest that creates a competitive bidding scenario, thus raising the value of your business to its maximum level. With the aid of proprietary software and a team of experienced research analysts, our M&A partner offers unparalleled buyer reach as part of its bespoke service.

Why choose CVS?

The market leader in company sales

We are partnered with the UK’s leading company sales specialist. They completed over 340 business sales last year alone – independently ranking them as the nation’s number one adviser by volume.

Expert buyer reach

Our partner provides unparalleled marketing and buyer reach, ensuring that the clients they represent are presented to only the most appropriate buyers and investors who have the motivation and the means to complete a transaction.

Complete project delivery

From initial buyer interest to completion of the transaction, our M&A partner will lead the process on your behalf and liaise with all parties to ensure a smooth sale.

No cost and no obligation consultation

There is no cost or obligation surrounding the initial exploration of your company sale, and all fees are detailed up front before you make your decision, and can even incorporate your legal fees.

What happens next?

Whether this valuation has clarified your thoughts on the future of your business, or you would like further advice before taking the next step, we have an experienced team available to listen and help. We offer every client an individual, personal service in which our vast knowledge of the M&A industry and cutting-edge research technology developed in-house are the cornerstones. Our directors are entrepreneurs themselves, so they fully understand, and can relate to, how important it is to make the correct decision for your business – with a desire to not only meet your objectives and expectations but to exceed them.

Make a confidential enquiry by emailing us:

[email protected]

Arrange a one-to-one consultation by giving us a call on 0203 441 2003

A leading sell-side adviser to SME owners considering an exit strategy, KBS Corporate have unparalleled buyer reach in the UK and overseas across a broad

range of sectors. They specialise in businesses with an enterprise value of up to £10million. Applying a boutique, tailored service for each client, KBS Corporate are dedicated to sourcing multiple potential buyers and generating a bidding scenario designed to maximise your choices and the value of your business.

Typically, Knightsbridge clients’ businesses have an enterprise value of up to £2million and are engaged in a wide variety of sectors including the retail, catering, care, commercial, licenced and leisure markets.Offering national coverage through regional managers and directors with a wealth of specific industry experience, blended with local knowledge and discretion, Knightsbridge ensure you will receive the highest quality advice and guidance.

Handling company sales typically in the £10million-£200million value range, KBS Corporate Finance have a strong track record of delivering deals to mid-market trade and private equity investors. Mandates are completely director-led from start to finish, partnering with you to provide an exceptional, dedicated personal service with full project management, expert transactional practice and deal execution.

A specialist M&A advisory company within the telecoms, technology and software sectors, Knight specialise in strategy services from one-off assistance to ongoing board advisory services. Due to their rich history of experience in the M&A industry, Knight can advise and provide support on all elements of a sale or acquisition, with the team offering unmatched expertise and a professionally-managed sales process